At Grassley’s Urging, CBO Director Testifies on the U.S. Budget Outlook for First Time Since 116th Congress

Today’s testimony marks a necessary reprieve from the committee's 19 prior climate hearings

WASHINGTON – Per Ranking Member Chuck Grassley (R-Iowa)’s request, the Senate Budget Committee is hosting Phillip Swagel, director of the nonpartisan Congressional Budget Office (CBO), to testify on the 10-year budget and economic outlook.

This Congress, Democrat committee leaders have predominantly focused on climate change and the environment; they also held a hearing on reproductive issues. Grassley has vigorously pushed back against the committee’s misguided agenda, noting the nation is at a crucial fiscal fork and calling for the committee to uphold its explicit responsibilities to the taxpayer: to consider economic policy and draft a sound budget. Below is Grassley's opening statement welcoming Director Swagel to the committee.

Thank you for agreeing to my request for today’s hearing with Director Swagel. It’s been nearly four years since the CBO Director last testified before the Senate Budget Committee on the nation’s budget outlook. That’s far too long for what’s traditionally been a routine occurrence in the Budget Committee — particularly given the budget hole we’ve dug ourselves into.

Federal Reserve Chairman Powell stated earlier this year that it’s, “Past time to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.”

Today in the Budget Committee, that conversation is finally taking place. Director Swagel, thank you for coming. And I think you’re going to tell each of us things we’d rather not hear. But that’s part and parcel of having what Powell called an “adult conversation.”

So is moving beyond the partisan blame game of who’s most at fault for our fiscal mess.

President Biden tried to play this game at the recent presidential debate, in an attempt to claim the mantle of fiscal responsibility. The reality is, President Biden had to be dragged kicking and screaming to agree to even modest spending restraint as part of last year’s Fiscal Responsibility Act.

The fact is, our nation’s debt will soon top $35 trillion. Next year’s interest payments will exceed $1 trillion. And in 10 years, Social Security will go broke if we don’t take bipartisan action to save it. I shouldn’t say go broke, because you’ll still have revenues coming in that’ll save 77 percent of what benefits are today.

CBO has warned Congress for decades that we’d face a fiscal reckoning due to ballooning mandatory spending. That reckoning is now at our door step. Absent action, rising debt will leave future generations facing higher interest rates, lower incomes, greater inflation and the risk of a full blown fiscal crisis.

Avoiding this requires a robust discussion of revenues and spending. As I’ve said in previous hearings, I have a record of going after genuine tax loopholes and wasteful carveouts, and I’m open to reviewing tax subsidies.

A very good place to start is with those in the so-called Inflation Reduction Act – which CBO has said actually increases inflation. Ending the law’s subsidies for luxury EVs and other regressive giveaways that have exploded in cost could net hundreds of billions in savings.

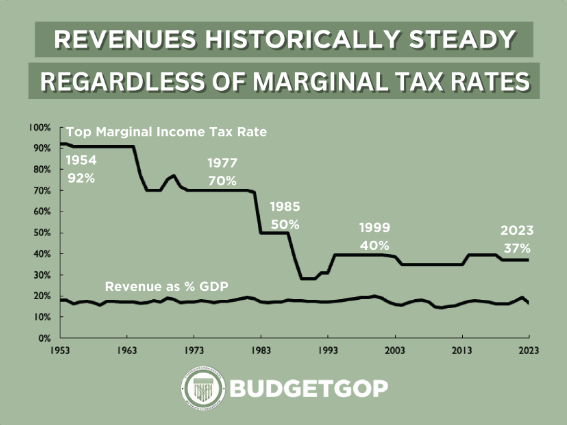

Contrary to claims from the Left, taxing the so-called rich is no silver bullet to our fiscal outlook. Even confiscating – I want to emphasize confiscating, not taxing – all income over $1 million wouldn’t close our $2 trillion deficit.

History proves that high tax rates fail to raise significant revenues. So, I’m repeating something I said here a couple meetings ago. Taxpayers, workers, and investors are smarter than we are. We’ve had a 93-percent marginal tax rate—then 70 percent marginal tax rates, 50 percent, 30 percent, back up to 40 percent, and you can go on and on. But, regardless of the rate, we’ve brought in about the same amount of revenue as you can see from this chart.

Rather than punish success, tax reforms should focus on incentivizing work, savings and investment. That’s what Federal Reserve Chairman Volker advised Congress in the 1980s at a similar time of large deficits and inflation. It was a recipe for success then and can be a recipe for success at this point.

Most importantly, we must have a frank discussion about Washington’s spending addiction.

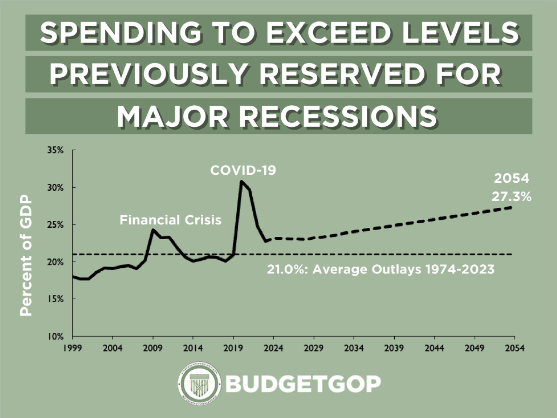

Whereas revenues are in line with historical levels, federal spending relative to the size of our economy is at heights previously reserved for wars and recessions – and still growing.

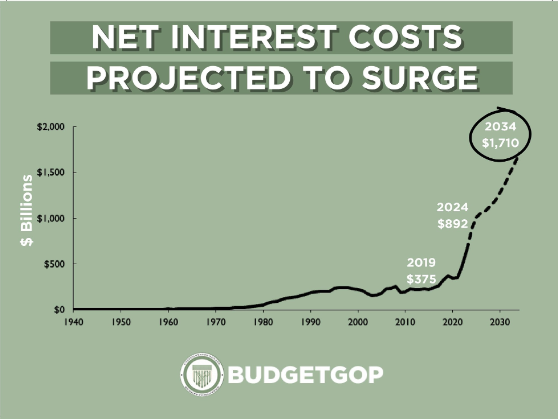

Record spending is driving up unprecedented debt and deficits, which fuel more spending in the form of ballooning interest payments. Interest costs are rapidly becoming one of the largest line items in the federal budget. Next year, we’ll see a new record as a share of our economy.

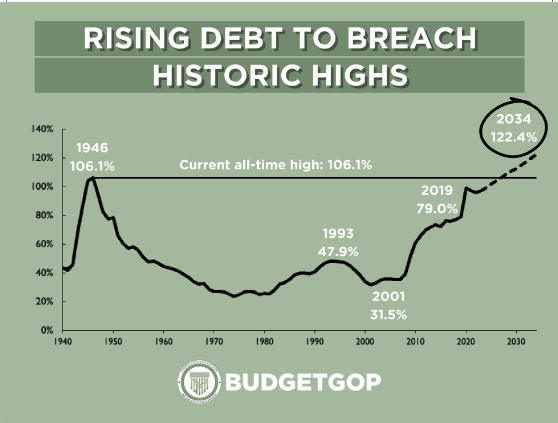

No single chart can capture the size and scope of our fiscal mess. But, the closest to it is a depiction of debt relative to the size of our economy. We’re on track to set a new record-high by 2027 – exceeding the World War II era-record.

While debt-to-GDP declined quickly after World War II, today, our debt is indefinitely projected to grow faster than the economy. That’s the definition of unsustainable.

Yet, President Biden continues to use his pen-and-phone to spend trillions, particularly on student loan bailouts. In these unprecedented fiscal times, that’s the height of recklessness.

We must stop digging ourselves into an ever-deeper budget hole. And I think the budget agreement reached between Biden and McCarthy a year ago starts us down that track, maybe not as aggressively as we should, but it’s still a start. We must find common fiscal goals that can serve as a catalyst for bipartisan action.

Can we agree that debt-to-GDP can’t increase forever without consequences?

Can we agree to a debt-to-GDP level we mustn’t cross?

One last note: This week marks the 50th anniversary of the Congressional Budget Act, which created CBO and the Budget Committee. A lot has changed since 1974, from the way Congress operates to the size and scope of federal spending. Updating the Budget Act for the 21st century is a shared goal worth continuing to work toward.

-30-

Next Article Previous Article