Grassley: Biden Policies Don't Bring Prosperity for All

Thank you, Mr. Chairman. I appreciate the subject of today’s hearing because I’ve spent my entire Senate career advancing policies that improve the livelihoods of ordinary Americans.

As a former chairman of the Finance Committee, I’ve personally shepherded legislation that delivered tax relief to working families and made the tax code more progressive.

Today’s hearing title suggests, though, that the Biden administration’s overspending and corporate cronyism have led to “prosperity for all.”

Well, I just wrapped up my annual meetings across Iowa’s 99 counties, and I can tell you that Iowans aren’t buying into this proposition that [Bidenomics] is a “prosperity for all” program. And they’re not alone. A clear majority of Americans disapprove of President Biden’s handling of the economy.

Just talk to ordinary folks. They’ll tell you that their paychecks don’t go as far as they used to and that the American Dream seems further out of reach.

So, let’s look at a few facts.

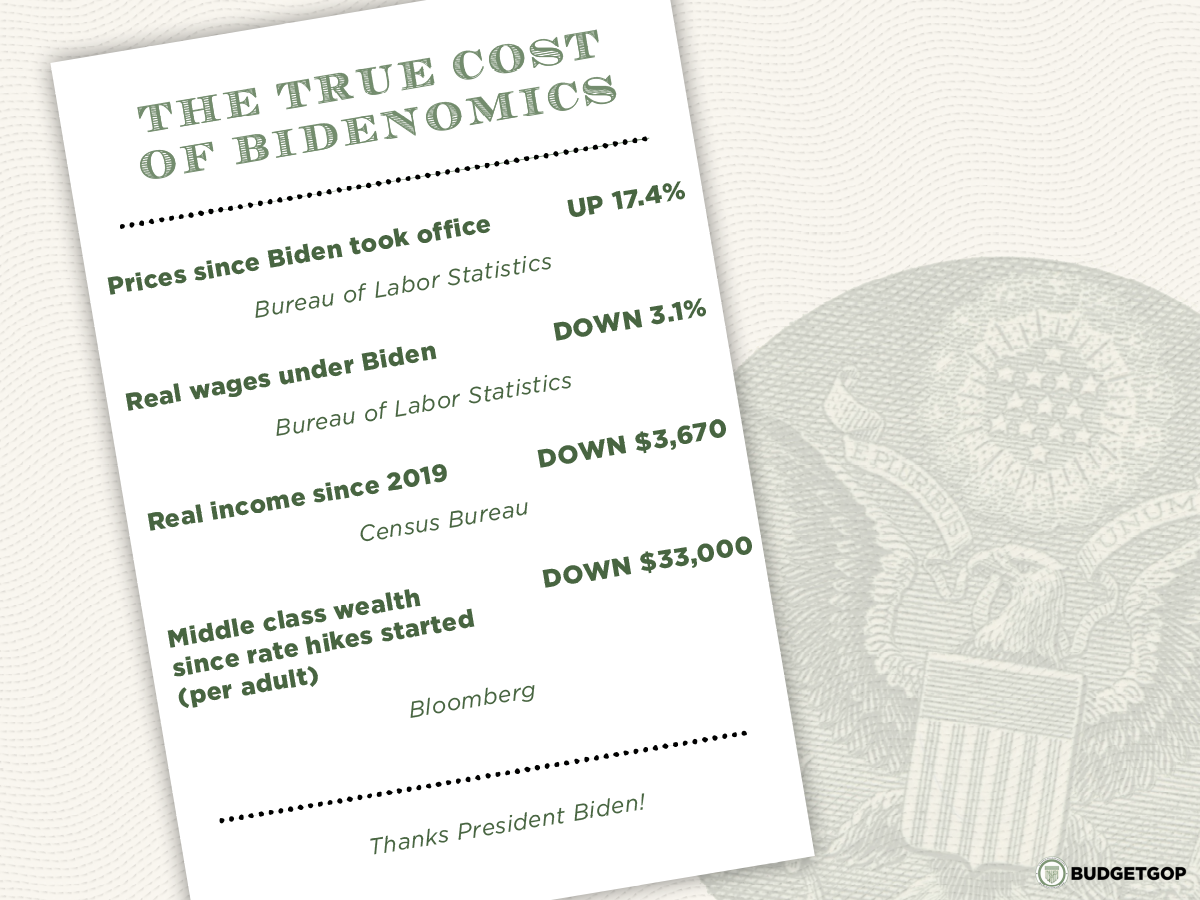

Thanks to the spending binge and energy policy blunders of the majority party and the president’s party, consumer prices have risen more than 17 percent since President Biden took office.

Inflation remains well above the Fed’s target and price hikes have accelerated the past two [months]. And even if we get inflation down to what the Fed wants at two percent, don’t forget the $7,000 a year that’s already in the economy as increased costs for families – it’s going to be there forever. Two percent inflation isn’t going to reduce that at all. Yet, to hear Democrats tell it, it seems they expect praise for prices not being even higher.

Inflation isn’t the only problem with this economy.

Just last week, the Census Bureau announced that real median household incomes fell $1,750 last year and are down $3,670 from 2019.

According to Bloomberg, the average middle-class adult has seen a staggering $33,000 drop in real wealth since the Fed started hiking interest rates. Moreover, skyrocketing mortgage rates have made homeownership the least affordable it’s been in nearly 40 years.

When you enact bad policies, what do you expect? You get bad outcomes. President Biden claims his economic strategy is about growing the economy from the bottom up. But when you look at many of his policies, the ones who benefit are the wealthy and well-connected.

According to Mr. Harris’s own Brookings Institution, the President’s student loan policies are costly, poorly targeted and provide substantial benefits to highly educated and well-off borrowers.

Then there’s the so-called Inflation Reduction Act, which even President Biden now admits wasn’t about reducing inflation. In fact, it has and will increase prices according to the non-partisan Congressional Budget Office. That bill was chock-full of corporate handouts and regressive new tax subsidies that even Democrat economists say will disproportionately benefit the wealthy.

With that said, Mr. Chairman, I don’t doubt that everyone on this Committee wants prosperity for all Americans. But I think the president’s economy and polices aren’t the answer to that.

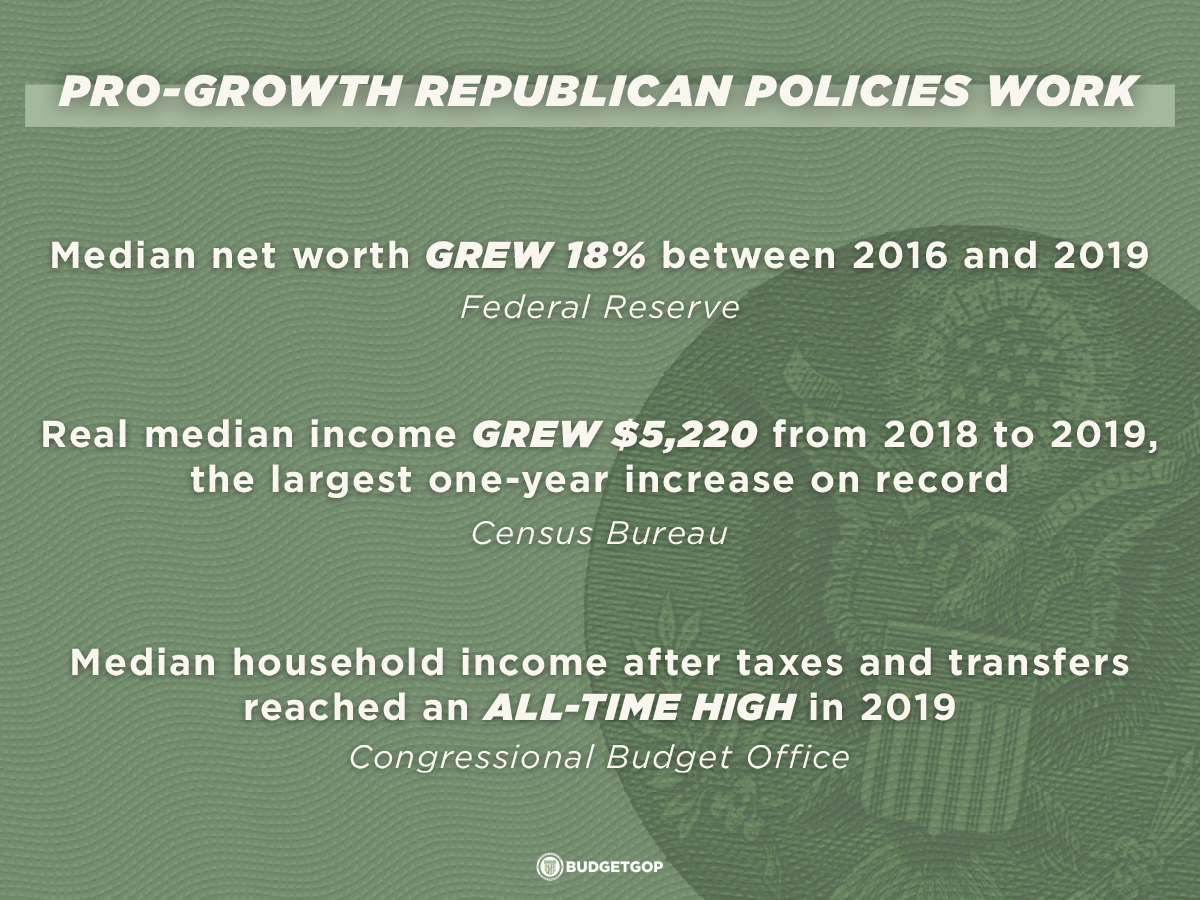

Experience shows us the best way to promote prosperity for all is through pro-growth policies that empower ordinary people rather than Washington. Republicans took that approach in the years immediately preceding the pandemic. The results were an economy where Americans saw gains.

Not only did we have historically low unemployment, but inflation was stable, interest rates were affordable and wages were rising faster than prices. In fact, blue-collar workers saw the biggest wage gains.

As a result, the Census Bureau, the Congressional Budget Office and the Federal Reserve all report that inequality fell and incomes went up.

Instead of raising taxes like my Democrat colleagues, we lowered taxes across the board, while making the tax code more progressive.

The 2017 tax law built upon 20 years of Republican led tax cuts that have removed millions of low-to-moderate income Americans from the tax rolls.

As a result, the bottom 20 percent of households have seen their average federal tax rate drop from over seven percent to only 0.5 percent today.

The working class has always been at the center of Republican tax relief efforts.

I welcome today’s witnesses. I look forward to hearing their testimonies and asking them questions.

-30-

Next Article Previous Article